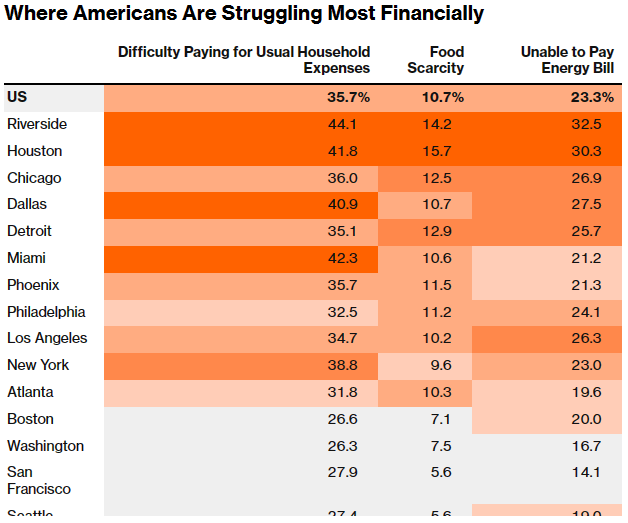

Almost half of households in Riverside, California, can’t afford usual expenses and about a third had trouble paying an energy bill in the last year, according to a Census Bureau survey.

Among the 15 largest US metro areas, Riverside had the highest share of respondents facing key measures of financial stress. In addition, one in seven said there was sometimes or often not enough to eat at home in the previous seven days, the latest Census household pulse survey shows.

Located about 50 miles east of Los Angeles, Riverside is at the heart of a warehousing-industry hub that boomed during the pandemic but has been showing signs of slowdown more recently. The metro area’s unemployment rate has jumped in the past two years to 5.5%, above the national average, and inflation there is also higher than the country’s average.

Note: Share of adults in households, sorted by the average of the 3 measures

The Census Bureau began the survey at the onset of the Covid-19 pandemic to provide policymakers with near real-time data on how Americans are doing. It includes measures of extreme poverty, such as whether respondents and their families are having trouble everyday bills, as well as employment, housing and wellbeing.

The picture is mixed across California. More than 85% of adults in San Francisco didn’t have an issue paying their energy bill, but more than a quarter said Los Angeles households couldn’t pay an energy bill in full during the previous year.

Food scarcity was the worst in Houston, a metropolitan area that also ranked high on other measures of poverty in the survey, which was conducted March 5 to April 1 and had about 70,000 respondents. By contrast, the share of people facing financial stress in Boston, Seattle and Washington, DC, was lower than the US overall.

Nationwide, 23.3% of the adult population live in households that struggled to pay an energy bill, and more than one-third of adults said it had been somewhat or very difficult to pay for usual household expenses in the last seven days.